salt tax repeal new york

Repeal of the SALT deduction limitation would be important at any time but as New Yorks residents and economy continue to recover from the impact of COVID-19 it has become imperative. The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022 and later an eligible entity may opt in on or after Jan.

Senate Democrats Fight To Lower New York Property Taxes Ny State Senate

New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline.

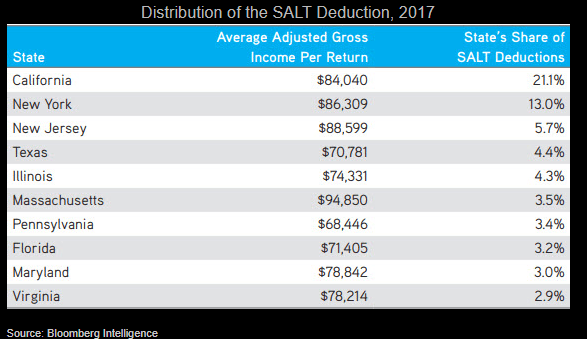

. The committee for a responsible federal budget described the repeal of the salt cap as a. That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people an extra 12 billion. The SALT limit deduction brought in 774 billion during its first year according to the Joint Committee on Taxation and a full repeal for 2021 may cost up.

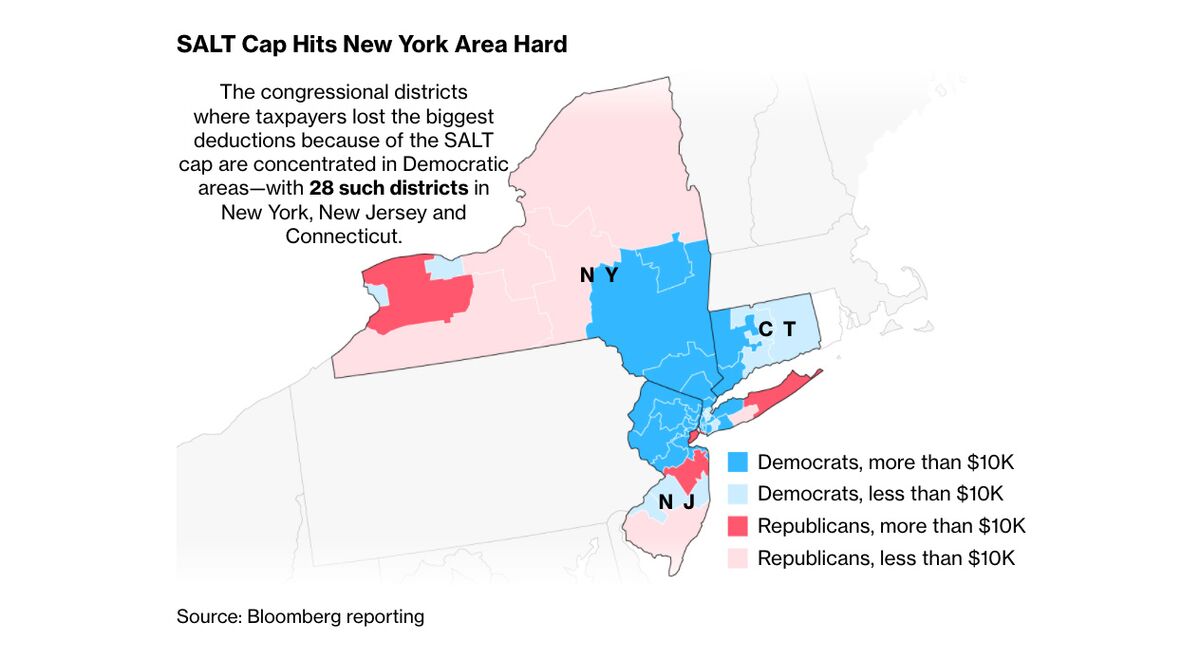

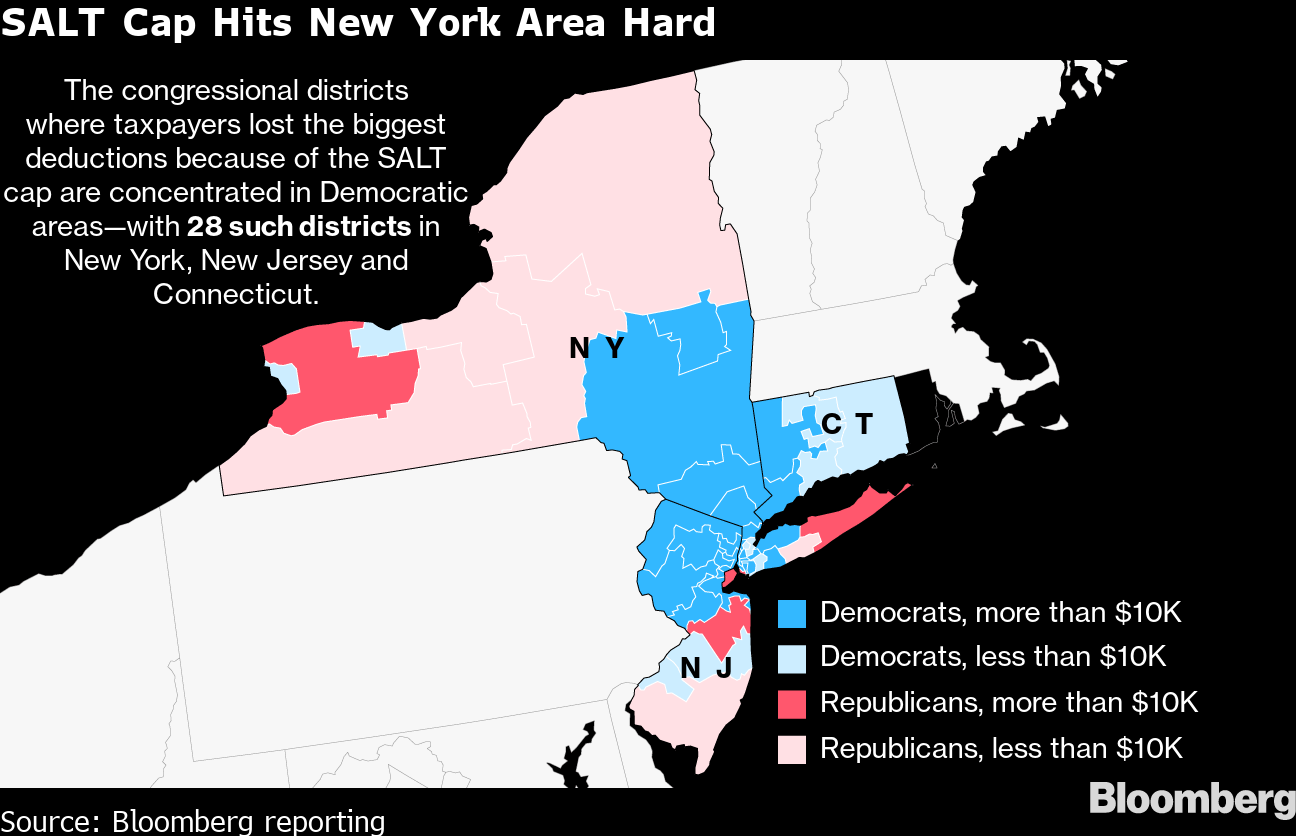

August 9 2021 833 AM 3 min read. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. With tax rates steady and the 10000 deduction cap under attack some residents of new york new jersey and california might get lower tax bills than before the 2017 tax cut.

Salt tax repeal new york. New York was hit first and hit hardest by the pandemic and as a result it lost over 1 million jobs in 2020. New Yorks SALT Workaround.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. But the Tax Cuts and Jobs Act limited that deduction to 10000. Recently NYSAC sent a letter to the New York Congressional Delegation.

New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. October 05 2021. 1 but no later than March 15 of the tax yearie by March 15 2022 for the 2022 tax year.

The elective tax does not have an expiration date concurrent with the sunset of the federal SALT cap. The cap was implemented as part of the 2017 Tax Cuts and Jobs Act. Tax Fairness for All Americans.

Is leading a drive in Congress by a group of lawmakers from New York and other high-tax states to raise the 10000 cap on state and. That was bad news for top earners in blue states such as California and New York. SALT-Cap Repeal Leader Tom Suozzi to Run for NY.

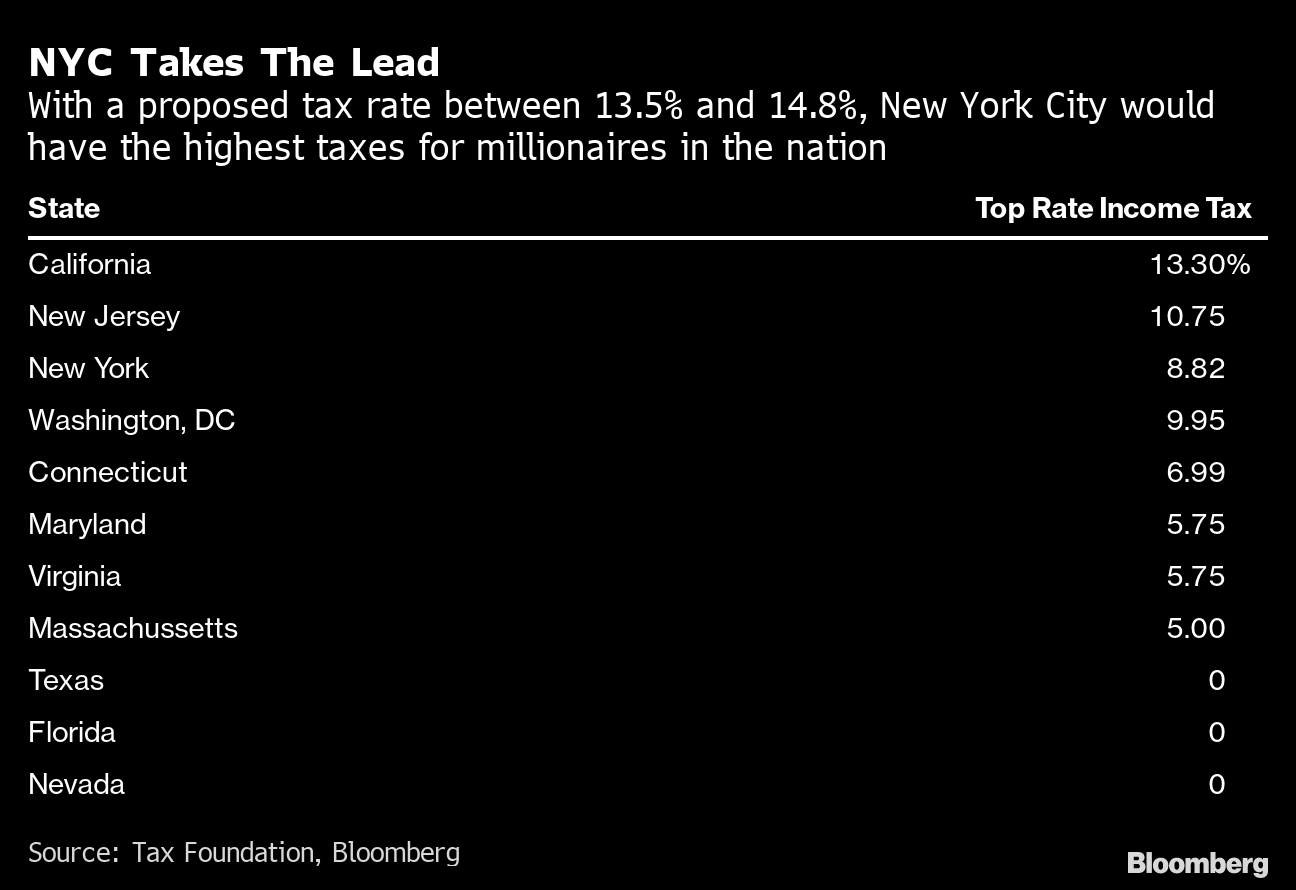

Paying a state income tax of 10 percent or more. Whats worse is that the law disproportionately hurts Democratic states like New York. A new bill seeks to repeal the 10000 cap on state and local tax deductions.

The Committee for a Responsible Federal Budget described the repeal of the SALT cap as a regressive tax cut estimating that it would cost. Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely for the wealthy opposed by most Republicans and some Democrats.

The fiscal 2022 Senate Democratic budget proposal released on Monday calls for SALT cap relief. Cuomo said the repeal is the single best piece of action for the state of New York adding he hopes it will make it into. New York seeks Supreme Court review of SALT cap.

Manchin has declined to say publicly how he feels about Schumers push to change the SALT cap which would be a major benefit for New York where top income earners pay state tax rates of. Congressman Tom Suozzis D-Long Island Queens efforts to repeal the cap on the State and Local Tax SALT deduction continues to gain momentum this time with the New York Daily News Editorial Board noting how Suozzi is absolutely right to stick to his No SALT No Deal demand in refusing to support any changes to the federal tax code unless the. A Democratic proposal aims.

A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the New York State Association of Counties NYSAC on April 28 to call for an end to the cap on the deductibility of state and local taxes known as SALT. Ny house democrats demand repeal of salt cap. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future. Residents of New York take the highest average deduction for state and. Kathy Hochul and Attorney General Letitia James was also supported by Connecticut.

11 rows New York Taxpayers. The push backed by Gov. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

New York Tax Rates Nyc S Richest Face Top Rate Of Over 50 Under Cuomo S Plan Bloomberg

New York Democrat Says Salt Deal Could Be Reached This Week Thehill

New York Tax Rates Nyc S Richest Face Top Rate Of Over 50 Under Cuomo S Plan Bloomberg

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Bipartisan Legislation To Fully Restore The Salt Deduction Introduced In House Of Representatives Congressman Thomas Suozzi

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Nys Budget Passes Includes Salt Cap Workarounds Excludes Non Cpa Ownership

Salt Deduction Redux May Spark High End Spend Opportunity Funds Bloomberg Professional Services

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

17 New York Democrats Threaten To Oppose Tax Bill Without Salt Restoration

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

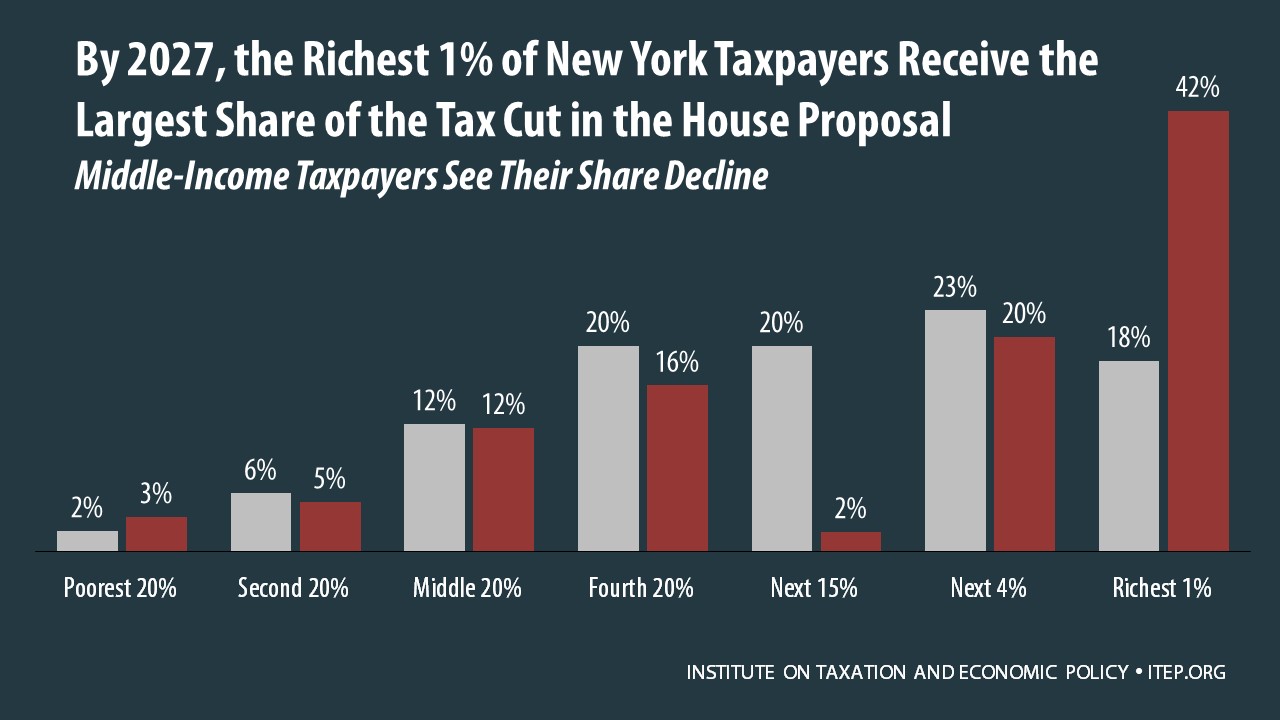

How The House Tax Proposal Would Affect New York Residents Federal Taxes Itep